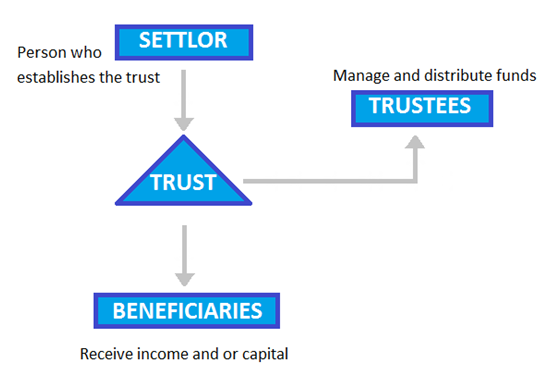

1. Not choosing the right trustee

We all know that our clients would rather not spend too much time thinking about what would happen to their children should they die prematurely. As such, clients are often quick to choose a close family member—their sibling or parent to act as the trustee. While this may seem like common sense to the client, they often fail to take into account factors such as age, health, distance, and judgement—all of which are extremely important in the selection of an appropriate trustee. Incompetence, negligence, and inability on the part of the trustee can result in the mismanagement of the trust, thus jeopardizing the trust’s ability to provide for the beneficiary’s needs. To help clients avoid these potential issues, an attorney can 1) guide clients in making a thoughtful trustee selection (family member vs. a bank/professional); 2) if one candidate doesn’t tick all the boxes, then advise appointing co-trustees (someone who has a good relationship with the beneficiary and another who is financially savvy); and 3) designate successor trustees in case the first trustee dies or becomes incapacitated.

2. Not considering a minor’s maturity level

When it comes to transferring wealth to younger generations, estate planners must remember that not all beneficiaries are responsible or prepared enough to handle a large inheritance. To protect a beneficiary from making bad financial decisions (like blowing all their money in Vegas, or buying all their friends Ferraris), attorneys counsel clients to consider using incentive provisions in a trust. An incentive provision establishes specific requirements that beneficiaries must meet before they can receive a distribution from the trusts. For example, an incentive provision may require a beneficiary to obtain a certain level of education, reach a certain age, maintain gainful employment, or assume a role in the family business before receiving a distribution from the trust. Trust incentives can also be used to discourage harmful behavior, such as in the event a beneficiary became addicted to drugs or alcohol, certain protective provisions would kick in, stopping all trust distributions until the beneficiary was drug tested. If the test was positive, then the trust could pay for rehab and the distributions would resume after the beneficiary tested clean.

3. Not including asset protection provisions

Divorce, car accidents, and bankruptcy happen every day. The odds are that your client’s kids will experience one or more of these things over their lifetime. Thus, it’s important to include asset protection provisions and language to protect beneficiaries (and their inheritance) from their would-be creditors and/or future ex-spouses. The first step is to include spendthrift provisions in the trust to ensure a beneficiary cannot assign the trust to a creditor. Next, ensure a client’s assets align with a trust. Only assets in a trust are protected by the trust’s provisions. Finally, have a system in place to track and validate a client’s assets over time (since we all know that a client’s circumstances will inevitably change). While it may be tempting to treat a trust as a “once and done” project, it is important to note that without these last two steps, a trust’s protective provisions are worthless. In addition, by providing these additional services, an attorney adds significant value to their practice, improves the client experience, and creates a potential for additional firm revenue in the future.