When arguments about inheritance arise, the pain of losing a loved one can multiply. This is especially true for those caught off guard by conflicts they never anticipated. Whether you’re expecting a battle over your estate or you are confident there will not be any fighting, it is a good idea to make sure your estate planning is well-drafted to reduce the likelihood of any future inheritance battles.

Some people might feel tempted to leave less fortunate family members or friends more of their assets and estate, but this decision can leave more financially stable loved ones feeling resentful or hurt. One common method to avoid hurt feelings and fighting over their assets is to instead divide an estate equally among beneficiaries. However, not every family’s situation is best served with this strategy. For those who require a different strategy to ensure all beneficiaries are treated fairly, it is important to meet with us so we can help you design a plan that benefits everyone.

Another good way to limit fighting is to avoid naming multiple family members as trustees or personal representatives, and instead name a qualified, third-party as a personal representative and/or trustee. Consider selecting someone you trust, or someone who has a legal or financial background. If you select a child, try to ensure the reasons for choosing one child over another are obvious and logical. Selecting a child because he or she is the oldest–even though they lack proper judgment–can cause years of resentment to be unleashed, while naming your child who is a CPA and lives down the street (regardless of that child’s birth order) makes a lot more sense.

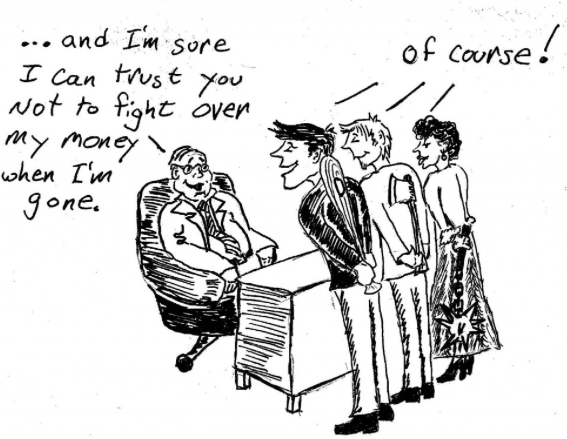

An additional way to curb the possibility of fighting among your family members is to clearly communicate your wishes to them during your lifetime. This can take many forms. At a minimum, you can briefly tell your family that you have had your estate planning documents prepared and where they are located. Alternatively, you can bring out the documents and go over them page by page. By letting your family members know about your estate plan, you mitigate much of the contempt that is so often brought on by secrecy.

For those concerned about problematic beneficiaries who may squander generational wealth, disinheritance is not the only solution, and may backfire if it fuels a legal challenge. One alternative to disinheritance is use of a discretionary trust. This type of trust requires that the beneficiary’s share be held by a neutral, third-party trustee, like a bank or trust company, and distributed to the beneficiary in the time and manner you have described. A discretionary trust enables you to provide for your beneficiary without the worry that the money will be wasted.

It is incredibly important for people of all ages to prepare estate plans and update them routinely. While it can be difficult to talk about money with your loved ones, looping them into your plans now is a good way to prevent fights over assets once you are gone.

By keeping your estate plan up to date and working with an experienced estate planning attorney, you can reduce the likelihood that your will or trust will being contested or that your family will be torn apart by a bitter legal battle. If you’re eager to create and maintain an estate plan that maintain family peace and harmony–and also will be difficult to overturn–call our office today at (614) 429-1053. We work hard to ensure the wishes of our clients are carried out with fidelity. No matter your goals, we aim to protect the assets you’ve acquired and secure financial stability for the next generation (and, if desired, beyond).

The information presented here has been prepared by Charles H. McClenaghan, LLC, for promotional and informational purposes only and should not be considered legal advice. This information is not intended to provide, and receipt of it does not constitute, legal advice. Nor does the receipt of this material create an attorney/client relationship. An attorney client relationship is not established until such time as Charles H. McClenaghan, LLC, enters in to a written engagement agreement with a specific client for a specific legal matter.

LEGAL NOTICE: THIS MESSAGE IS AN ADVERTISEMENT AND SOLICITATION.