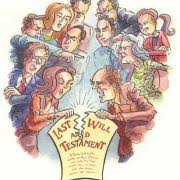

Loan, Gift, or Advancement: Why the Classification Matters

Loan, Gift, or Advancement: Why the Classification Matters We all want to provide financial help to our loved ones, but it’s important to understand that how the money is classified will affect your estate planning! Understanding the Differences The intent behind the transfer of the money is key when determining if it will be considered…